- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Perfect Reversals in Gold and USD - Are You Ready for the Perfect Moves?

Yesterday’s session was just perfect.

The initial reaction was in tune with what made sense given Fed’s rate cut, but it was soon overwhelmed by the buy-the-rumor-sell-the-fact type of reaction. The one that you knew was coming.

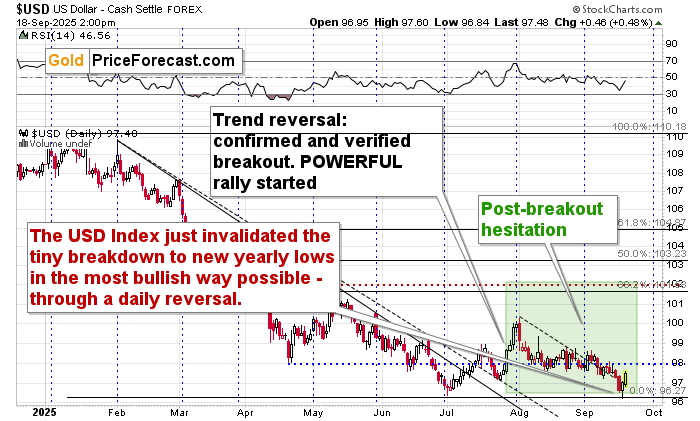

Gold declined and the USD Index rallied back up, both created reversals. Gold a bearish one, and the USD Index - a bullish one. Both moves continue today – gold is down, and the USD Index is up. While gold’s and miners’ decline might be turning most heads, it’s the USD Index’s picture that holds the key to understanding what’s most likely to happen next.

The USD Index formed a bullish daily reversal (hammer candlestick pattern) and this – along with today’s rally clearly invalidated the breakdown below the July low.

This is a very powerful buy signal for the USD Index, especially that it happened when the rates were cut – which ‘should’ fundamenally trigger declines. It didn’t because the market was WAY ahead of itself and the USD Index was sold and shorted as if the rates had been cut much more than they actually were. As if the tariffs were bearish for the USD and not bullish.

Yesterday’s rate cut likely served as a reality check – well, the rates were cut, but nothing more. They were not cut by 0.5% despite Trump’s calls for a “big cut”.

Again, despite all that has been thrown at the USD recently – it refused to move to new yearly lows. This is the key thing here.

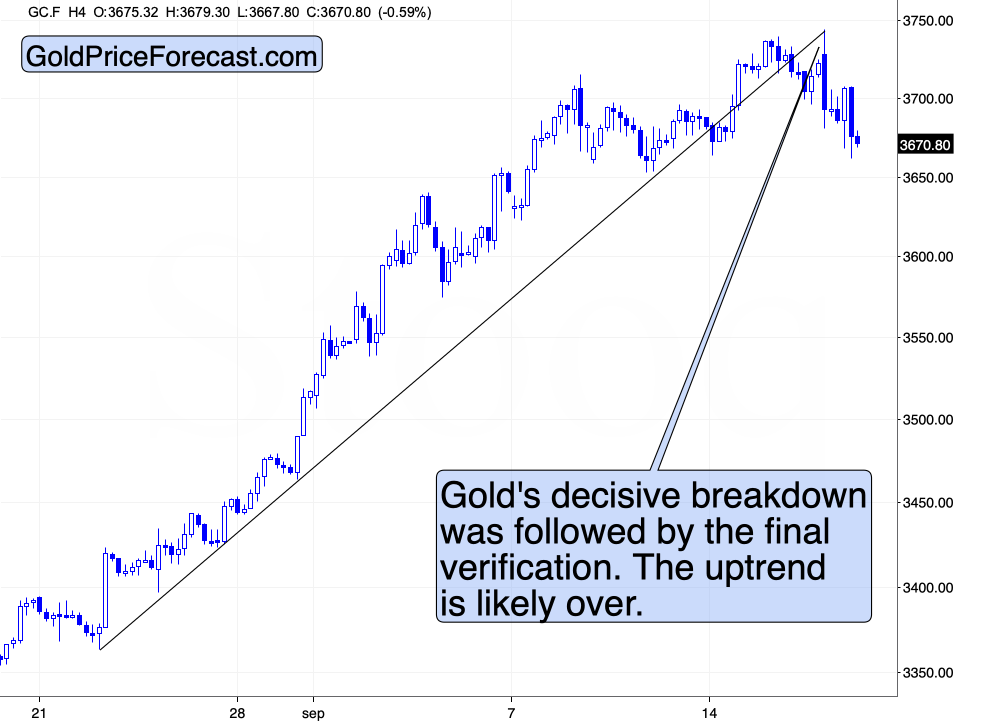

As the USD Index is up, gold is down and what’s particularly important here is that it’s back below its recent intraday high. What’s also important is that it now clearly broke below the rising support line visible on the below 4-hour candlestick chart.

It even verified the breakdown by moving back to the previously broken line and topping right at it. The uptrend is most likely over.

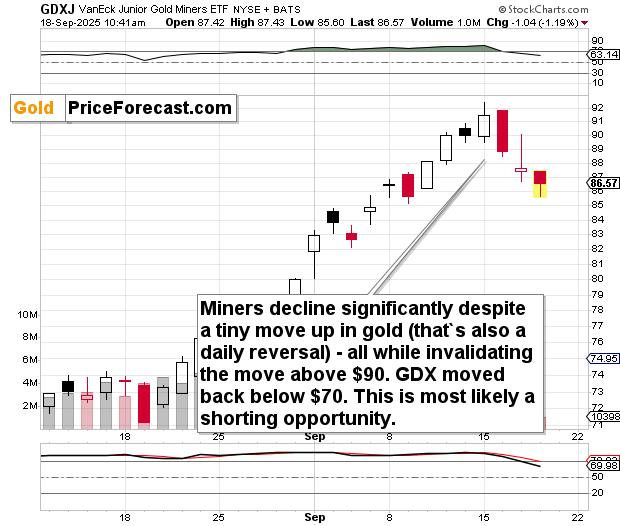

Meanwhile, the GDXJ ETF is down once again. So far, only last week of gains was erased, but given where the USD Index is, it’s very likely that we’ll see September’s rally erased as well.

And then miners are likely to decline even more.

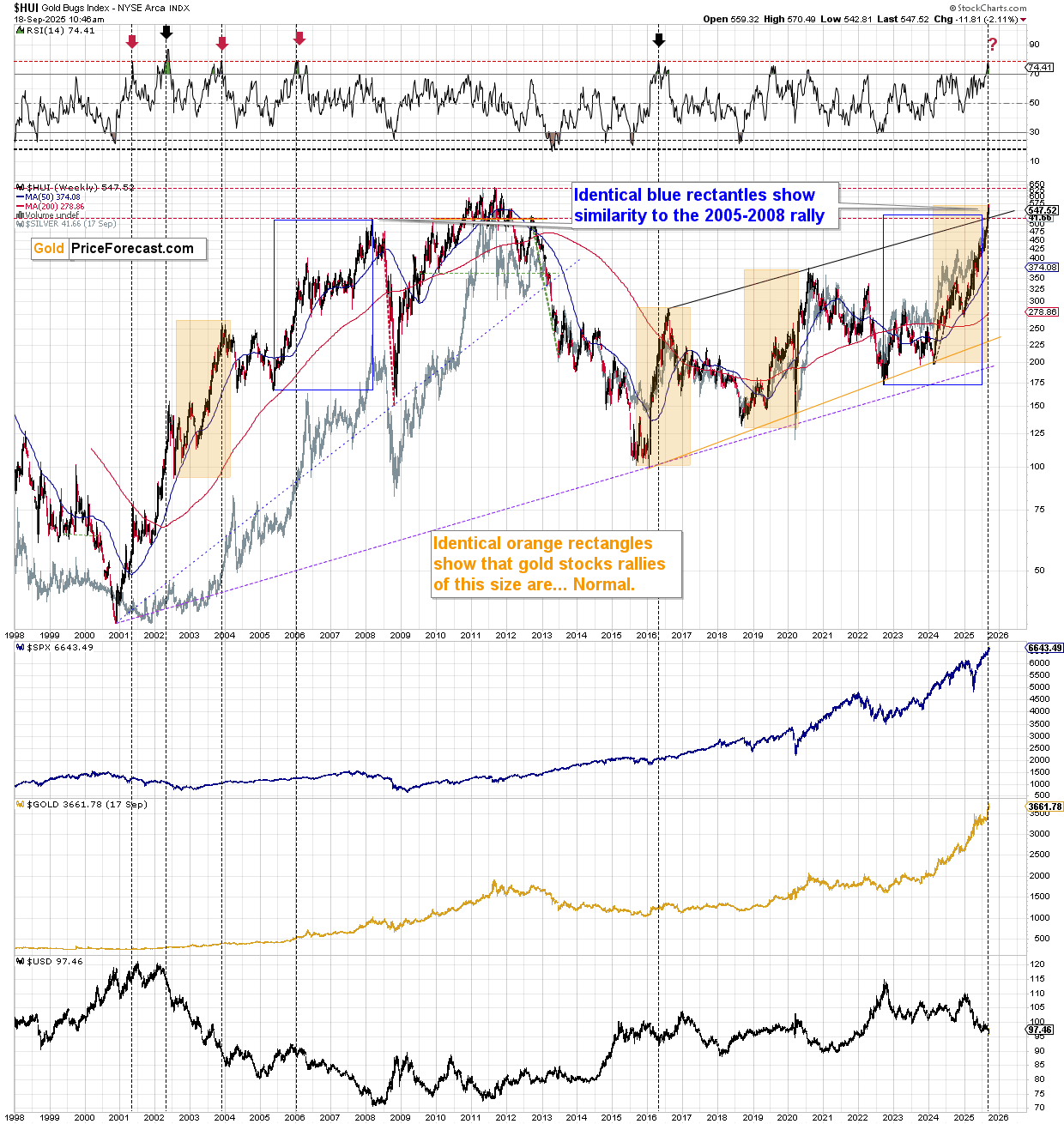

Again, the USD Index is most likely after a major bottom and mining stocks are likely to be hit really hard when the rally in the former gains momentum.

Remember, gold stocks already rallied by how much they were likely to rally during this (previous) medium-term upswing. That’s what the orange rectangles show on the above HUI Index (proxy for gold stocks) chart.

On Tuesday, I wrote about entering or adding to the short positions in mining stocks, and so far it seems that it was a good decision. If my theory about the USD, precious metals and other markets is correct – and markets’ performance appears to be confirming this – then this is just the beginning.

Webinar With John T. Seguin

This week is particularly rich in events. And I don’t mean “just” the key reversals in the USD, gold, and mining stocks. I mean the fact that we just had a webinar with Peter B. Levant (it was great – we’ll feature its recording shortly), and that we’re hosting another one tomorrow.

This time, we’re going to feature John T. Seguin and since this webinar has been requested by multiple subscribers, I’m sure you’ll enjoy it. John has a lot to tell – not only about his career as a floor broker, but about his special system of analyzing the charts that already resulted in multiple profitable trades – just this month alone.

John is posting at least 10 (yes!) trades in both directions each day, and the profits are often taken several times further from the entry than the stop-loss. This DDOG trade, for example, shows John’s methodology in action.

Prepare your questions and join John tomorrow at 11 AM ET (5 PM CET) – reserve your spot now.

Thank you.

Sincerely,

Przemysław K. Radomski, CFA