- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Learn How to Use Gamma Exposure to Spot Chart Support, Resistance, and Stock Squeezes

Options traders often watch volume, open interest, and flow. But there’s another force quietly shaping markets: Gamma Exposure (GEX).

In this clip from a popular Barchart video, Gavin McMaster explains how gamma exposure works, why it matters, and how you can use it to anticipate volatility, support, and resistance.

What Is Gamma Exposure?

Gamma is an options Greek that reflects how sensitive an option's price is to changes in the price of the underlying asset. It measures the rate of change of delta, known as the “hedge ratio” - and when gamma exposure is extreme, it means market makers can be forced to hedge their positions quickly.

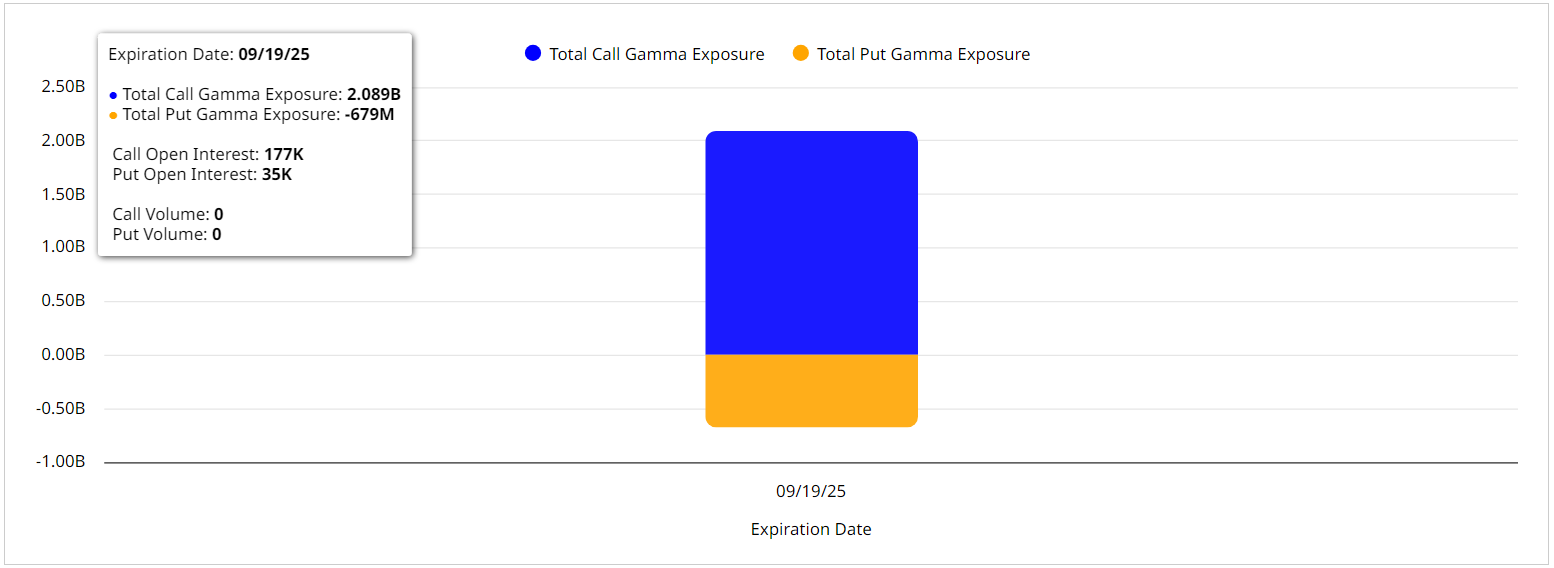

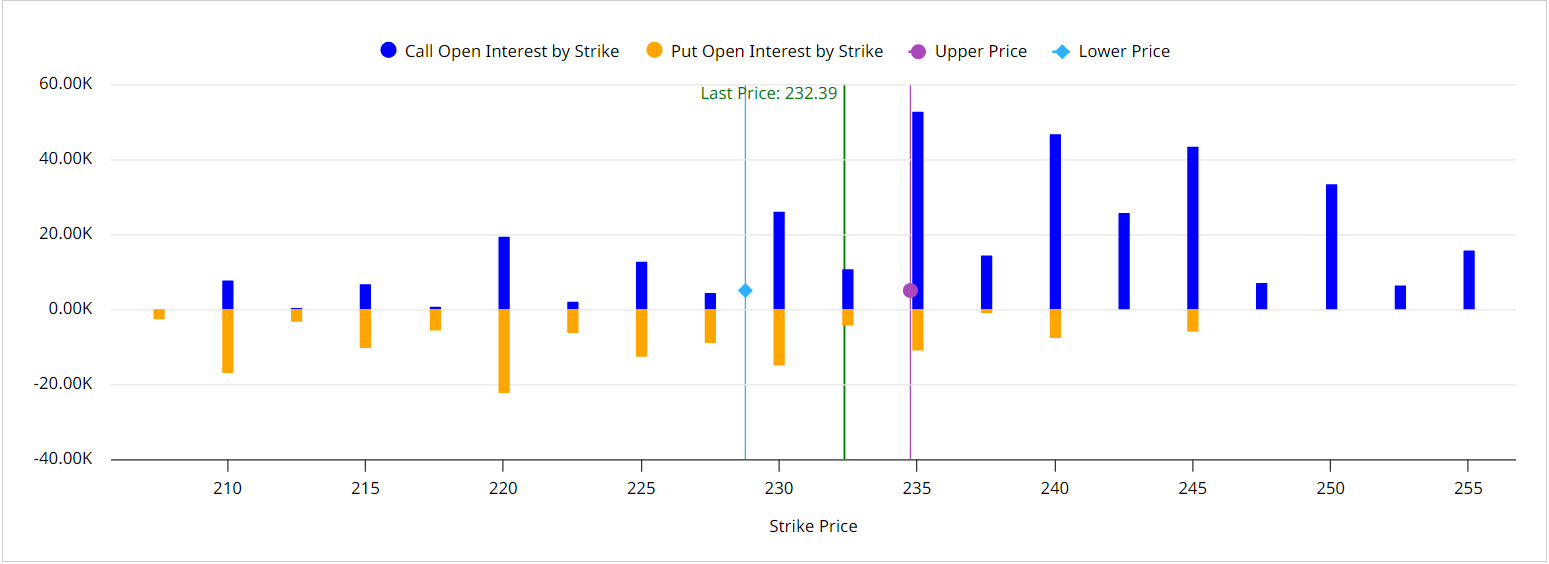

- Calls = Positive Gamma

- Puts = Negative Gamma

Gamma exposure levels are highest near the current price of the underlying as contracts approach expiration.

Looking at Amazon (AMZN), in Gavin’s example:

- The higher strikes show heavy positive gamma.

- Net gamma exposure is clearly positive — the blue bars (calls) dwarf the yellow bars (puts).

Why It Matters for Traders

Positive Gamma → Lower Volatility

Market makers hedge by buying when prices fall and selling when prices rise, keeping moves contained.

Negative Gamma → Higher Volatility

Market makers hedge the opposite way, selling into weakness and buying into strength.

This creates feedback loops — the kind we saw during the epic runs in GameStop (GME) and AMC (AMC), which were essentially gamma squeezes.

These dynamics explain why certain strike levels act as hidden support or resistance, and why volatility spikes when gamma flips negative.

How to Use Gamma Exposure

- Check Barchart’s Gamma Exposure tool to see which strikes carry the most hedging weight.

- Watch for positive vs. negative flips — they can signal calmer markets or explosive volatility.

- Pair GEX with Options Flow to confirm institutional positioning.

Bottom Line

Gamma Exposure takes options Greeks beyond theory to give you a practical edge in trading. It shows you where market makers must hedge, giving traders insight into hidden pressure points that drive price action.

Watch the clip where Gavin McMaster explains the basics of gamma exposure in action:

- Catch the full video, Unlock the Power of Gamma Exposure to Boost Your Options Trading.

- Unlock the Options Flow tool with a free 30-day trial of Barchart Premier and start trading with the same data professionals use.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.