- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

‘Landmines’ Ahead: Sell Chewy Stock Before June 11

Online pet products retailer Chewy (CHWY) is set to report its first-quarter results. Before that event, Mizuho analyst David Bellinger downgraded Chewy. Bellinger believes that the company’s growth has been “fully embedded in expectations.” He also sees this downgrade as a “positioning call,” seeing potential “landmines” in its upcoming results.

The company is also facing a leadership change, with CFO David Reeder expected to step down from his post, which might induce some volatility. Chewy has a lot to prove in its next earnings. Should you sell the stock before that?

About Chewy Stock

Launched in 2011 and based in Plantation, Florida, Chewy (CHWY) is one of the biggest online pet products retailers in the U.S. The company offers approximately 130,000 products and services, with competitive prices and fast shipping. With a market cap of roughly $19.2 billion, Chewy has had a stellar performance over the past year, driven by its strong fundamentals and solid business momentum.

Last year, Chewy received significant attention from meme investors. The reason was that stock influencer Keith Gill, more famously known as “Roaring Kitty,” unveiled his stake in the company. However, this investment was short-lived as it was dissolved in October. Recently, Chewy has attracted the attention of institutional investors from BC Partners, who have invested in a stake worth $7.1 billion, representing 53.1% ownership in the company. This indicates that Chewy is now one of the sought-after stocks in the market, as consumers continue to spend on their furry friends.

The company posted a fresh 52-week high of $48.62 this June and is only 4.3% off from this high. Over the past year, Chewy’s stock has surged by an impressive 102.6%, and has climbed 37.2% year-to-date. In contrast, the broader S&P 500 Index ($SPX) has seen modest gains of 12.% over the past year and 2.3% in 2025, highlighting Chewy’s substantial outperformance in the market.

On the other hand, Chewy has a high valuation, which suggests that the stock might face some correction in the near term. The stock is currently priced at an eye-watering 192.84 times trailing earnings, which is significantly stretched compared to the industry average.

Chewy’s Q4 Results Were Better Than Expected

On March 26, Chewy reported robust results for the fourth quarter that exceeded expectations. The company’s net sales came in at $3.25 billion, up 15% year-over-year. This surpassed the $3.20 billion that analysts were expecting. Chewy’s adjusted EPS climbed by 56% from the prior year’s period to $0.28, which was higher than the $0.20 that Wall Street analysts were expecting. Its adjusted EBITDA increased 44% year-over-year to $124.53 million, exceeding the analysts' expectations of $118.20 million.

One of the reasons Chewy’s results were comparatively better than the year-ago values is that fiscal 2024 Q4 had one extra week to count. The company’s platform also attracted more customers. Its active customer count surged by 2% from its year-ago value to 20.51 million, while net sales per active customer increased 4% to $578. At the center of Chewy’s growth are its Autoship customers.

For Q4, the company’s Autoship customer sales were $2.62 billion, up 21% year-over-year and accounting for about 81% of its total top line. Chewy expects its Q1 2025 top line to grow in the range of 6%-7% year-over-year to $3.06 billion to $3.09 billion. Its adjusted EPS is expected to land between $0.30 and $0.35. Chewy is set to report its Q1 results on June 11 before the market opens.

For the fiscal year 2025, Chewy projects its net sales to grow by 6%-7% to $12.30 billion to $12.45 billion. Meanwhile, analysts are optimistic. For the current fiscal year, EPS is expected to surge by 66.7% to $0.45, followed by an increase of 53.3% to $0.69 in the next fiscal year.

What Do Analysts Expect for Chewy Stock?

Despite the growth projections, analysts have given tepid forecasts on Chewy’s stock. Mizuho analyst David Bellinger downgraded the stock from “Outperform” to “Neutral” due to a shift in the expectations about the company’s future performance. However, Bellinger also raised the price target on Chewy from $43 to $47, which shows a positive outlook on the stock’s future valuation.

Citing valuation concerns, analysts at Jefferies also downgraded Chewy from “Buy” to “Hold,” while raising the price target from $41 to $43. Analysts believe that the benefits that Chewy is receiving from its sponsored advertisements and alternative data from its platforms have already been factored into its valuation, which might limit potential gains.

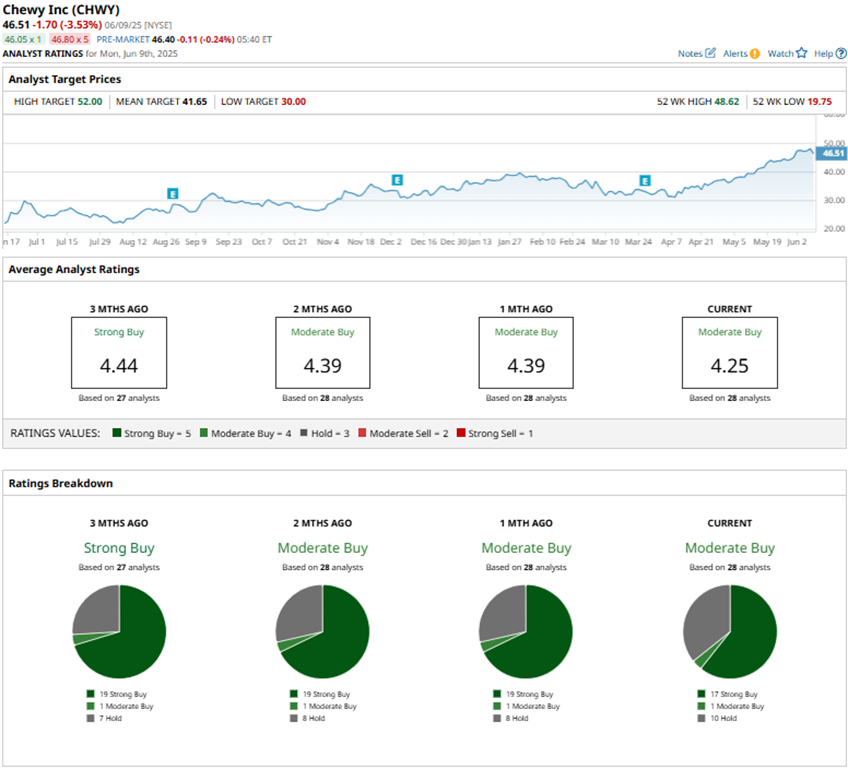

Wall Street still appears somewhat optimistic on CHWY, giving it a consensus rating of “Moderate Buy” overall. Based on the 28 analysts’ ratings on the stock, 17 have rated it a “Strong Buy,” one suggests a “Moderate Buy,” while 10 analysts are taking the middle road with a “Hold” rating. However, analysts also project a potential correction. The consensus price target of $41.65 represents potential downside of 10.4% from current price levels.

With some analysts waving a yellow flag and a CFO heading for the exit, Chewy’s upcoming earnings report is more than just numbers. It’s a high-stakes moment for the pet retailer. While recent gains have certainly been impressive, Mizuho analyst David Bellinger’s specific warning of “landmines” in Q1 and the market’s sky-high expectations suggest a potentially rocky ride ahead.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.